Dieser Artikel wurde ursprünglich auf Englisch veröffentlicht.

February 12, 2026

Innovation im Vermögensmanagement [Tech & Trends 2026]

Entdecken Sie Trends und Technologien für innovatives Wealth Management.

Inhaltsverzeichnis

Das Umfeld des Wealth Managements hat sich verändert im Vergleich zu vor einigen Jahren. Die Erwartungen der Kunden sind gestiegen, die Technologie hat sich weiterentwickelt und Innovation hat sich von der Seitenlinie ins Zentrum des Gesprächs bewegt.

Deshalb brauchen Unternehmen, die wachsen und relevant bleiben wollen, ein schärferes Verständnis der Schlüsseltrends, die Innovation im Wealth Management prägen und der Technologien, die diese ermöglichen.

Dieser Artikel beschreibt beide Aspekte und zeigt, wie sie in der Praxis zusammenwirken.

Wichtige Erkenntnisse

Personalisierung ist jetzt ein Standard, kein Unterscheidungsmerkmal mehr

Kunden erwarten Beratung, die ihr komplettes finanzielles Bild widerspiegelt, nicht nur ein Modellportfolio. Unternehmen, die Daten über Ziele, Verhalten und Präferenzen hinweg vereinheitlichen können, sind besser positioniert, um relevante, durchgängige Erfahrungen in großem Maßstab zu liefern.Hybride Beratungsmodelle definieren die Rolle des Beraters neu

Automatisierung und KI übernehmen viel analytische und administrative Arbeit, während sich menschliche Berater auf Urteilsvermögen, Vertrauen und komplexe Entscheidungen konzentrieren. Dieser Wandel ermöglicht es Unternehmen, Beratung zu skalieren, ohne Qualität zu opfern.Private Märkte werden Teil von alltäglichen Portfolios

Volatile und stark korrelierte öffentliche Märkte drängen Investoren zu Alternativen. Fractional Ownership, semi-liquide Strukturen und Private Credit machen private Vermögenswerte zugänglich und operationell im großen Maßstab für Wealth Manager.Innovationsverhalten in Unternehmen verändert sich, nicht nur die Produkte

Mit steigender Komplexität rückt Innovation näher an die Frontlinie, Experimente erfordern klare Grenzen, und Kultur wird ein Ausführungsfaktor. Unternehmen, die keine strukturierten Wege zur Erfassung von Ideen, zum verantwortungsvollen Testen und zur Unterstützung von Mitarbeitern haben, riskieren, in eine reaktive, trendgetriebene Innovation zu verfallen.End-to-End-Innovationsinfrastruktur wird zum Unterscheidungsmerkmal

Die Umwandlung von Ideen in messbare Ergebnisse erfordert Systeme, die Ideenbeschaffung, Bewertung, Ausführung und Governance verbinden. Plattformen wie rready helfen Wealth-Unternehmen, Innovation in großem Maßstab zu operationalisieren und ermöglichen Innovationen, die diszipliniert, wiederholbar und auf Langlebigkeit ausgelegt sind.

4 Schlüsseltrends, die Innovation im Wealth Management prägen

Innovation im Wealth Management ist nicht mehr optional. Diese vier Trends zeigen, wohin sich der Fokus der Branche verlagert und was den Erfolg in der Zukunft bestimmen wird.

1. Steigende Erwartungen an personalisierte Wealth-Erlebnisse

Personalisierung ist in allen Branchen ein Minimum. Über 70 % der Verbraucher erwarten mittlerweile personalisierte Erlebnisse und viele ziehen sich schnell zurück, wenn sie diese nicht erhalten.

Wealth Management bildet keine Ausnahme.

Kunden möchten keine Beratung mehr, die auf breite Segmente oder Modellportfolios aufgebaut ist. Sie erwarten Führung, die ihre Ziele, Werte und Lebenskontext widerspiegelt.

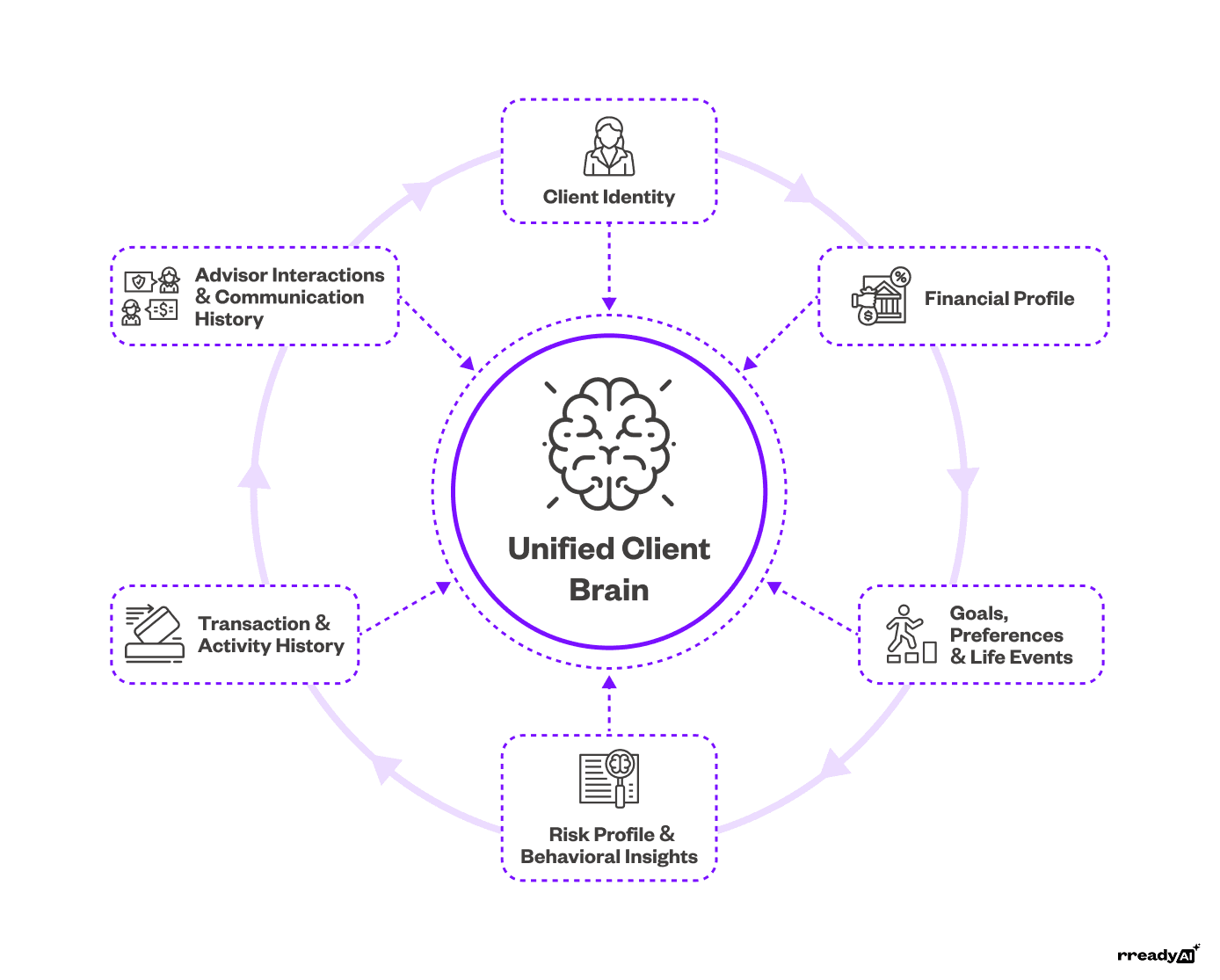

In der Praxis bedeutet Personalisierung im Wealth Management den Aufbau eines vereinheitlichten Verständnisses des Kunden, oder des sogenannten Unified Client Brain, in dem Elemente wie:

Portfoliodaten

Risikoprofile

Präferenzen

Echtzeitverhalten

Diese Grundlage ermöglicht alles von direktem Indexing und Steueroptimierung bis hin zu kontextualisiertes, stets verfügbares Engagement und ganzheitliche Planung, geliefert mit der Effizienz und Konsistenz, mit der die Branche seit jeher zu kämpfen hatte.

2. Der Wandel zu hybriden Beratungsmodellen

Der Aufstieg von Robo-Advisors zeigt, wie gewöhnt sich Kunden an digital-first Beratung gewöhnt haben.

Im Wealth Management treibt diese Dynamik hybride Beratungsmodelle an, die Automatisierung mit bedarfsorientierter menschlicher Expertise kombinieren.

Häufige Beispiele sind:

Automatisierte Portfoliokonstruktion und -ausgleich, gepaart mit menschlicher Anleitung für bedeutende Lebensentscheidungen

KI-unterstützte Finanzplanung, bei der Berater bei komplexen Steuer-, Nachlass- oder Governance-Fragen eingreifen

Digitaler Selbstservice für tägliche Bedürfnisse, unterstützt durch Relationship Manager, wenn Emotionen oder Abwägungen am wichtigsten sind

Was diesen neuen Ansatz innovativ macht, ist die Fähigkeit der heutigen Technologie, die Schwerstarbeit zu leisten, sodass Berater sich auf Urteilsvermögen, Vertrauen und die Momente konzentrieren können, die langfristige Wealth-Ergebnisse wirklich definieren.

3. Erweiterter Zugang zu privaten Märkten und alternativen Investments

Private Märkte sind nicht mehr nur institutionellen Investoren und Superreichen vorbehalten.

Im Jahr 2026 werden Wealth Manager zunehmend Zugang zu Private Equity, Private Credit, Immobilien und anderen Alternativen für eine viel breitere Kundenbasis bieten.

Dieser Wandel wird durch drei Schlüsselfaktoren angetrieben:

Öffentliche Märkte sind volatiler.

Traditionelle Vermögenswerte sind stärker korreliert als früher.

Investoren suchen nach Diversifikation und neuen Ertragsquellen.

Um der wachsenden Nachfrage nach Diversifikation und differenzierten Renditen gerecht zu werden, überdenken Unternehmen, wie alternative Investments bereitgestellt werden.

Fractional Ownership, semi-liquid Fundstrukturen und kuratierte Private-Market-Plattformen senken Eintrittsbarrieren und lindern langjährige Bedenken hinsichtlich Liquidität und Komplexität.

Private Credit gewinnt insbesondere an Fahrt, da die traditionelle Kreditvergabe sich verengt und Erträge schwerer zu finden sind.

Dieser Trend prägt die Innovation im Wealth Management, indem er Unternehmen dazu drängt, neue Vertriebsmodelle, Risikorahmen und Kundenerfahrungen zu entwickeln und Alternativen von Nischenprodukten zu einem skalierbaren Teil der täglich erlebten Portfolios zu machen.

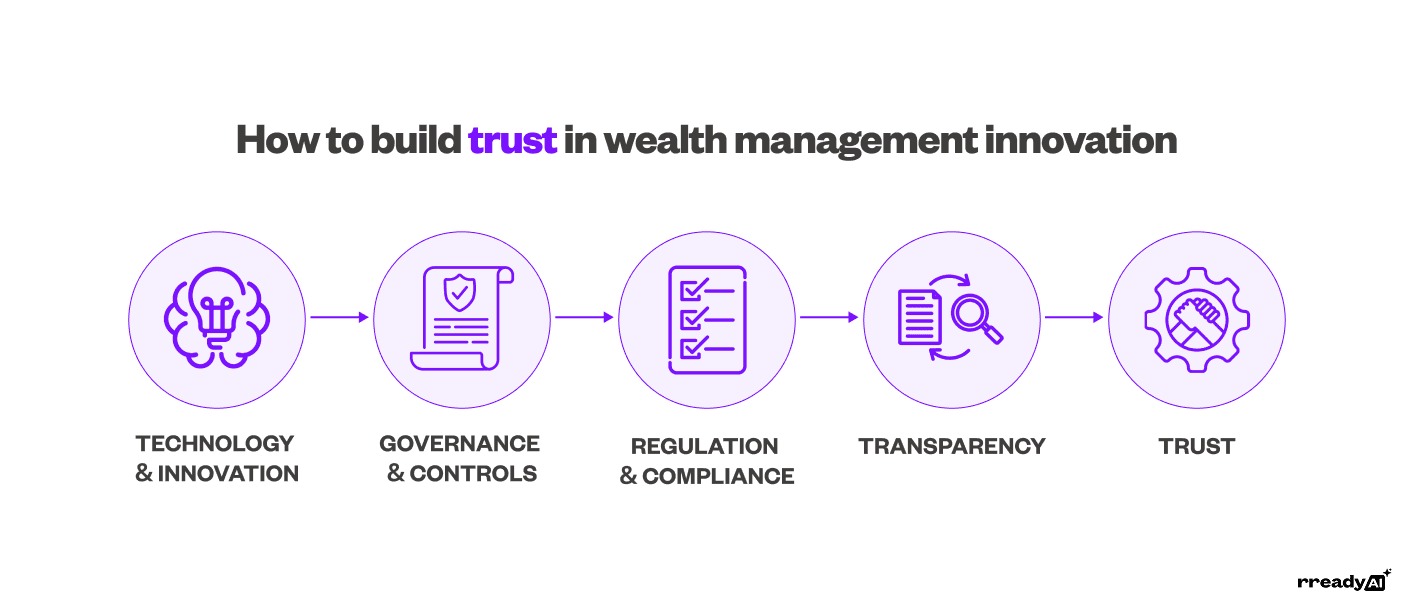

4. Stärkere Fokussierung auf Governance, Transparenz und Vertrauen

Während die Innovation im Wealth Management beschleunigt, wird die Aufsicht zu einem Kernbestandteil des Wertversprechens.

Kunden erwarten intelligentere, schnellere Dienstleistungen, aber auch Klarheit, Verantwortlichkeit und Schutz.

Der zunehmende Einsatz von Künstlicher Intelligenz (KI), Automatisierung und datengesteuerter Beratung drängt Unternehmen dazu, Governance-Rahmen um Datenqualität, Modellverhalten und Entscheidungsfindung zu stärken.

Gleichzeitig steigt die regulatorische Komplexität.

Grenzüberschreitende Datenregeln, KI-Regulierungen und Souveränitätsanforderungen bedeuten, dass Unternehmen präzise sein müssen hinsichtlich:

Wo Daten liegen

Wie sie genutzt werden

Wer sie kontrolliert

Transparenz gewinnt ebenfalls an Bedeutung. Klare Gebührenstrukturen, erklärbare Empfehlungen und sichtbare Schutzmaßnahmen werden zu Grundanforderungen.

In diesem Umfeld wird Vertrauen durch sichere Systeme, verantwortungsvolle Technologienutzung und Governance verstärkt, die mit der Innovation Schritt hält.

Was diese Trends für die Innovationsweise von Wealth Unternehmen bedeuten

Zusammen deuten die Trends, die Innovation im Wealth Management prägen, auf einen Wandel hin, der über Produkte, Plattformen oder Kundenerfahrungen hinausgeht. Sie verändern grundlegend wie Innovation in Wealth Unternehmen stattfindet.

Hier sind drei Wege, wie sich dieser Wandel in der Praxis zeigt:

1. Innovation rückt näher an die Frontlinie

Personalisierte Beratung, hybride Modelle und stets verfügbare Engagements bedeuten, dass viele der wertvollsten Innovationssignale jetzt dort entstehen, wo Kunden und Berater täglich interagieren.

Das bedeutet, dass diejenigen, die der Arbeit am nächsten sind, jetzt Reibungspunkte, ungedeckte Bedürfnisse und Verbesserungsansätze erkennen.

Daher müssen Unternehmen, die mithalten wollen, Wege finden, um systematisch Ideen aus der gesamten Organisation zu erfassen, nicht nur aus Innovations- oder Digitalteams. Auf diese Weise wird Innovation inklusiver, verteilter und in realer Erfahrung verwurzelt.

Ein strukturierter Ideenmanagementansatz, wie die Idea Management-Lösung von rready, hilft Unternehmen, Ideen an einem Ort zu sammeln, Duplikate zu eliminieren und diejenigen mit der größten strategischen Relevanz und Wirkung zu priorisieren.

2. Experimentieren wird innerhalb klarer Grenzen notwendig

Erweiterter Zugang zu privaten Märkten, KI-gesteuerte Entscheidungsfindung und datenintensive Dienstleistungen erhöhen sowohl Chancen als auch Risiken.

Unternehmen müssen neue Ideen schneller testen, aber sie müssen dies auch verantwortungsvoll tun, mit klarer Aufsicht und Nachverfolgbarkeit.

Dies verschiebt das Innovationsverhalten weg von Ad-hoc-Experimenten hin zu strukturiertem Testen, das umfasst:

Annahmen früh validieren

Beweise sammeln

Informierte Entscheidungen treffen, was skaliert, verfeinert oder gestoppt werden soll

3. Kultur wird zu einem Ausführungsfaktor

Mit der Beschleunigung der Trends im Wealth Management spielt Kultur eine bedeutende Rolle dabei, wie Unternehmen sich anpassen.

Mitarbeiter brauchen Raum, um Ideen beizutragen, Annahmen zu hinterfragen und sicher zu experimentieren. In der Praxis bedeutet dies:

Gut etablierte Prozesse für Ideen und Entscheidungen

Gewidmete Zeit zur Erkundung und Validierung von Ideen

Sichtbare Unterstützung der Führungskräfte für Experimente

Das ist die einzige Möglichkeit, damit Innovation wiederholbar wird und über das Verfolgen von kurzlebigen Trends oder das Abhängig sein von individueller Begeisterung hinausgeht.

Genau das passierte bei LGT, einer der führenden Privatbanken der Welt.

Als die Digitalisierung die tägliche Arbeit umgestaltete, führte LGT das KICKBOX Intrapreneurship-Programm von rready ein, eine Mitarbeiter-geführte Initiative, die den Teams einen klaren Prozess zur Einreichung und Prüfung von Ideen, gewidmete Zeit neben ihren Hauptaufgaben, und Unterstützung der Führung bei der Weiterentwicklung vielversprechender Initiativen bot.

Ideen wurden transparent bewertet und von der Validierung über den Pilotversuch bis zur Umsetzung vorangetrieben, was es LGT ermöglichte, Innovationen zu risikominimieren und Mitarbeiter an allen Standorten zu motivieren.

Innerhalb eines Jahres hatte sich das Programm zu einer globalen Innovationsgemeinschaft mit mehr als 1.200 Mitarbeitern entwickelt, mit Ideen aus allen Standorten und Dutzenden von Initiativen, die validiert, pilotiert oder umgesetzt wurden.

4 Technologien, die Innovation im Wealth Management ermöglichen

Wie Wealth Unternehmen intern innovieren, ist ein Teil der Gleichung. Der andere ist die Technologie, die die Branche selbst transformiert.

Diese vier Technologien ermöglichen die Trends, die das Wealth Management im Jahr 2026 neu gestalten.

1. Künstliche Intelligenz und agentische KI

Im Wealth Management sehen Unternehmen klar das Potenzial der KI: 95 % erwarten, ihre Investitionen in KI in den nächsten drei Jahren zu erhöhen, was signalisiert, dass KI zu einer Kernkompetenz wird.

Und diese Dynamik kommt nicht überraschend.

Wie Führungskräfte großer Technologieanbieter betonen, ist die Fähigkeit der KI, riesige Informationsmengen zu verarbeiten, zu verbinden und darauf zu reagieren, senken die Barrieren, die einst ganze Teams überwinden mussten.

Doch wie ermöglicht KI in der Praxis Innovation?

Zu Beginn unterstützt sie Berater, indem sie von der Portfolioüberwachung bis zur Empfehlungsvorbereitung Forschung, Analyse und Routineaufgaben automatisiert und dadurch Zeit für Urteilsvermögen, Beziehungen und komplexe Entscheidungen freimacht.

Außerdem ermöglicht KI personalisiertere Beratung, indem sie das vollständige finanzielle Bild eines Kunden analysiert, nicht nur seine Investments.

Was das Jahr 2026 jedoch wirklich auszeichnet, ist der Aufstieg von agentischer KI.

Anders als frühere Werkzeuge, die auf Anfragen reagierten, können diese Systeme Situationen überwachen, Entscheidungen treffen und mehrstufige Aktionen ausführen, wie:

Portfolios neu ausbalancieren basierend auf Echtzeit-Marktsignalen

Steuerstrategien auslösen, wenn Schwellenwerte erreicht sind

Zeitgerechte Kundenansprache initiieren, wenn Aufmerksamkeit erforderlich ist

Obwohl menschliche Aufsicht weiterhin unerlässlich ist, entwickelt sich KI von einem Hintergrundassistenten zu einem System, das aktiv den täglichen Betrieb des Wealth Managements steuert.

2. Fortschrittliche Daten- und Analyseplattformen

Daten waren im Wealth Management schon immer wichtig; das Neue ist, wie verbunden, umsetzbar und funktional sie geworden sind.

Im Jahr 2026 gehen Unternehmen über statische Berichte und fragmentierte Dashboards hinaus zu Analyseplattformen, die Entscheidungen im gesamten Unternehmen aktiv gestalten.

Moderne Datenfundamente vereinen Kundeninformationen, Marktsignale und Verhaltensabläufe in einer einzigen, nutzbaren Ansicht. Dies ermöglicht es Unternehmen, Chancen früher zu erkennen, konsistenter zu handeln und das zu skalieren, was funktioniert.

In der Praxis werden diese Plattformen genutzt, um:

Den richtigen Moment zu identifizieren, um einen Kunden oder Berater anzusprechen

Empfehlungen für den nächsten besten Schritt in Beratung und Vertrieb zu fördern

Onboarding zu optimieren und administrative Reibung zu verringern

Beraterzeit von der Vorbereitung auf kundenorientierte Gespräche zu verlagern

Im Wesentlichen sind Analysen jetzt in den täglichen Arbeitsablauf eingebettet. Infolgedessen wird Wachstum weniger von individuellen Heldentaten abhängig und mehr von wiederholbaren Systemen, die über Zeit feinabgestimmt, gemessen und verbessert werden können.

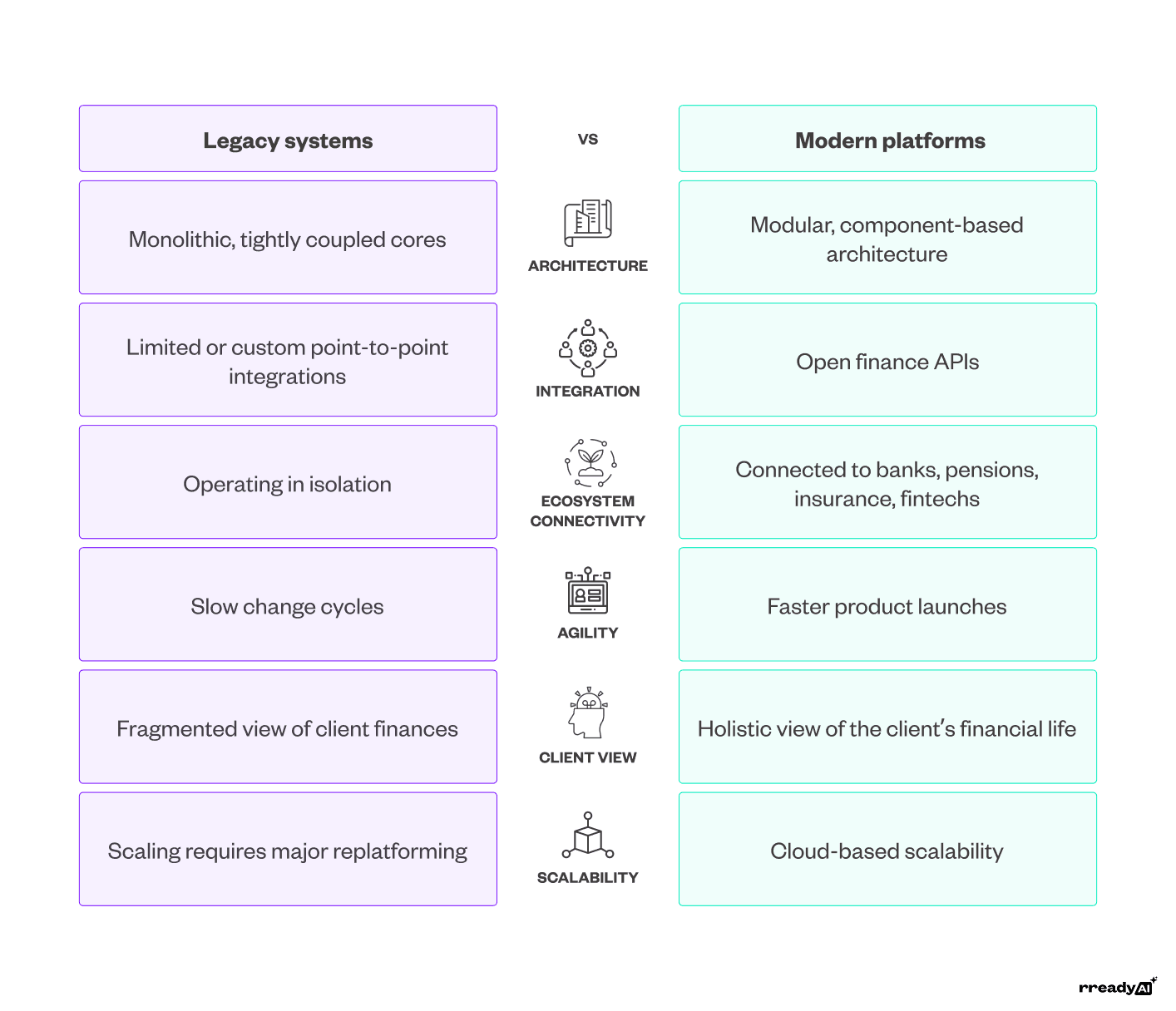

3. Open-Finance-APIs und modulare Plattformarchitekturen

Seit Jahren war Innovation im Wealth Management durch Legacy-Systeme eingeschränkt, die schwer zu ändern und noch schwerer zu verbinden waren.

Im Jahr 2026 modernisieren Unternehmen jedoch ihre Kernplattformen, um modular, flexibel und bereit für Integration zu sein.

Open-Finance-APIs ermöglichen es Wealth-Plattformen, sicher mit externen Systemen zu kommunizieren, von Banken und Pensionsanbietern bis hin zu Versicherungen und Fintech-Apps. Statt isoliert zu sein, wird Wealth Management Teil eines umfassenderen finanziellen Ökosystems.

Gleichzeitig erleichtern modulare, cloud-basierte Architekturen das Hinzufügen neuer Fähigkeiten, ohne alles von Grund auf neu aufzubauen.

Zusammen ermöglichen diese Technologien:

Eine umfassendere Sicht auf das finanzielle Leben eines Kunden

Schnellere Produkteinführungen und Partnerschaften

Nahtlose Erlebnisse über Kanäle und Plattformen hinweg

Diese neuen Fähigkeiten ermöglichen es Unternehmen, sich kontinuierlich zu entwickeln, schneller auf Veränderungen zu reagieren und Kunden überall dort zu treffen, wo sie sind.

4. Blockchain, Tokenisierung und digitale Vermögenswert-Infrastruktur

Blockchain findet zunehmend seinen Platz im alltäglichen Wealth Management als Infrastruktur, die die Funktionsweise von Vermögenswerten hinter den Kulissen verbessert.

Tokenisierung ermöglicht es, Investitionen wie Private Equity, Private Credit und Immobilien digital darzustellen, was sie leichter teilbar, übertragbar und verwaltbar macht.

Diese Veränderung ermöglicht:

Zugriff auf Fraktionierungsvermögen, die zuvor für die meisten Investoren unzugänglich waren

Schnellere und transparentere Abwicklung, was betriebliche Reibung reduziert

Tokenisierte Cash-Modelle, die Kapital erlauben, Ertrag zu erzielen, bis es eingesetzt wird

Mit zunehmender Reife der regulatorischen Rahmen und robuster digitaler Verwahrung bewegen sich diese Fähigkeiten in Mainstream-Wealth-Plattformen.

Die folgende Tabelle zeigt, wie diese Fähigkeiten sowohl den Betrieb der Unternehmen als auch die Kundenerfahrung im Wealth Management verändern.

Fähigkeit | Was sich für Unternehmen ändert | Was sich für Kunden ändert |

Tokenisierte Vermögenswerte | Neue Modelle für Vertrieb und Service in privaten Märkten | Leichtere Teilnahme in zuvor unzugänglichen Anlageklassen |

Tokenisiertes Geld | Treasury-, Preis- und Gebührenmodelle verlagern sich über Einlagen hinaus | Kapital bleibt flexibel und ertragsgenerierend |

Digitale Verwahrung | Klarere Governance und betriebliche Kontrolle | Sicherer Zugriff durch vertraute, regulierte Plattformen |

Die Infrastruktur hinter Innovation mit rready aufbauen

Als AI-native Innovationsplattform kombiniert rready Idea Management, KICKBOX Intrapreneurship und End-to-End Innovationsmanagement in ein einziges System, das Organisationen hilft, von Mitarbeitern getriebene Ideen in greifbare Ergebnisse zu verwandeln.

In Bezug auf die Aspekte, die das Wealth Management prägen, unterstützt rready Innovation durch:

KI und agentische KI: Sie können KI anwenden, um Ideen von hoher Wirkung zu identifizieren, Muster zu erkennen und klare Entscheidungen darüber zu treffen, was vorangebracht, verfeinert oder gestoppt werden soll.

Beraterproduktivität: Berater und Frontline-Teams können Ideen einbringen, ohne ihren täglichen Arbeitsablauf zu unterbrechen.

Ökosystem- und Plattformdenken: Teams sind funktionsübergreifend vernetzt, sodass Innovation kontinuierlich und nicht in isolierten Initiativen stattfindet.

Governance und Vertrauen: Bewertung, Transparenz und Rückverfolgung sind in jeder Phase des Innovationsprozesses eingebettet.

Auf diese Weise profitieren Innovationen von derselben Disziplin, Skalierbarkeit und Klarheit, die die Technologie bereits dem Wealth Management selbst gebracht hat, sodass Unternehmen mit Vertrauen investieren, Ressourcen gezielt einsetzen und das, was funktioniert, skalieren können.

Um sich der langen Liste erfolgreicher Projekte anzuschließen, die von rready unterstützt werden, vereinbaren Sie eine maßgeschneiderte Demo und sehen Sie, wie es die Innovation in Ihrem Unternehmen unterstützen kann.

Mehr erfahren

Open Innovation und Closed Innovation: Der Unterschied

Vergleichen Sie Open Innovation und Closed Innovation und sehen Sie, welcher Ansatz besser zu Ihren Zielen, Ihrer Kultur und Ihrem Risikoprofil passt.

February 12, 2026

Interne und externe Innovation: können beide zusammenwirken?

Entdecken Sie, wie interne und externe Innovationsquellen die Geschäftspraxis und -ergebnisse beeinflussen.

February 12, 2026

Innovation im Vermögensmanagement [Tech & Trends 2026]

Entdecken Sie Trends und Technologien für innovatives Wealth Management.

February 12, 2026